New mortgage customers need significantly higher incomes in order to buy a home, according to a new report.

The Banking and Payments Federation has found nearly €80,000 is needed to secure a draw down.

Just 13 percent of first time buyer mortgages and 7 percent of mover purchase mortgages were backed by incomes of up to €60,000 last year.

It means that as house prices go up, so too does the joint salaries needed to draw down a mortgage.

As is always the case, the government's line is that it must increase supply of housing to bring prices down.

Wicklow had the highest household income for new properties, while just a quarter of mortgages in Limerick were on new builds.

Annual Spring Clean Month Arrives Across County Wicklow

Annual Spring Clean Month Arrives Across County Wicklow

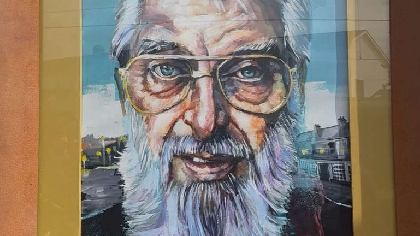

Totem Of Singer Ronnie Drew Unveiled At Greystones Train Station

Totem Of Singer Ronnie Drew Unveiled At Greystones Train Station

Public Consultation Opens On Future Use Of Public Building In Carnew

Public Consultation Opens On Future Use Of Public Building In Carnew

Construction Starts On New Solar Farm Near Blessington

Construction Starts On New Solar Farm Near Blessington

Site At Magheramore Beach Sold At Auction To Private Owner For €613,000

Site At Magheramore Beach Sold At Auction To Private Owner For €613,000