Revenue has outlined the details of how people will be expected to pay back any money owed.

Usually any income tax or USC is taken out before you ever get your wages.

But this didn't happen with the pandemic unemployment payment or wage subsidy scheme, largely due to how quickly the supports were brought in.

So if you've been on one of these payments, you may owe tax to the government.

In January next year everyone will be presented with a statement saying whether you've paid enough tax, overpaid or underpaid.

If you do get landed with a bill Revenue are being flexible with how it's paid.

You can pay it fully or partially off in January if you've been putting money aside or have some savings to do so.

If not, then the money will be taken out of your tax credits, interest free, over a four year period starting in January 2022.

Revenue expect this to ease the hardship for anyone landed with a big tax bill in January and the government doesn't expect the reduced tax take to have a massive impact on the projected tax taken in for 2021.

Wicklow Safe Haven Launches To Raise Awareness Of Domestic Abuse

Wicklow Safe Haven Launches To Raise Awareness Of Domestic Abuse

Wicklow Fire Service Attend To Fire On Coillte Lands Near Djouce Woodlands

Wicklow Fire Service Attend To Fire On Coillte Lands Near Djouce Woodlands

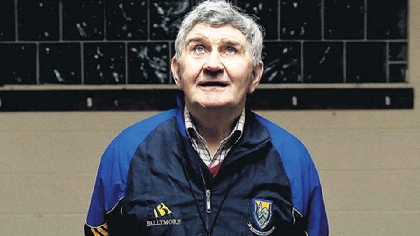

Tributes Paid To Former Wicklow GAA Manager Mick O' Dwyer Following His Death Aged 88

Tributes Paid To Former Wicklow GAA Manager Mick O' Dwyer Following His Death Aged 88

Planning Application Lodged To Turn Wicklow Pub Into IPAS Centre

Planning Application Lodged To Turn Wicklow Pub Into IPAS Centre

Inquest Hears 2 Year Old Girl Died Of Brain Damage Following Choking Incident At Greystones Creche

Inquest Hears 2 Year Old Girl Died Of Brain Damage Following Choking Incident At Greystones Creche