Jack Chambers and Paschal Donohoe have been outlining the largest budget in the history of the State.

The budget will be €8.3bn of new money, a 6.9% growth on last year. Here are some of the highlights:

- Main tax credits will increase by 125 euro on personal, employee and earned income. Higher rate of tax rises 2k to 44k. USC will see the 4% rate reduced to 3%

- Minimum wage to rise by 80c to 13.50 an hour from Jan 1st

- Entry rate to 3% rate of USC will rise to 27k

- A full time worker on the minimum wage will see their net income rise by 1,424 annually

- Increase in the Carer Tax Credit by 150. Single person child carer by 150, incapacitated child credit by 300, dependent relative credit by 60

- Blind tax credit to increase by 300 euro

- Inheritance tax increasing from 335 to 400k from a parent. 32,500 to 40k for Group B. 16,250 to 20k for Group C.

- The exception to allow employers to give employees vouchers or other non-cash rewards is increasing from 1,000 to 1,500 a year

- Payments to women under the Cervical Check payment scheme will be exempt from tax

- The Help to Buy scheme is being extended until the end of the decade.

- The 9% rate of VAT on gas and electricity is being extended six months to 30th April 2025.

- Tax credit on unscripted production at a rate of 20 per cent on expenses of up to 15m for the audiovisual sector. 20m for film productions under the 481 tax credit.

- 186m new funding to regenerate towns and urban areas

- Government has agreed the Apple money should be used across water, electricity, transport and housing as four key pillars. Investment framework being developed

- Free schoolbooks extended to all secondary schools

- Money to keep schools smartphone free and allow them to buy tech to do that

- 3bn euro for the climate transition funds. Reduction of greenhouse gas emissions, water quality or biodiversity will be looked at

Wicklow Safe Haven Launches To Raise Awareness Of Domestic Abuse

Wicklow Safe Haven Launches To Raise Awareness Of Domestic Abuse

Wicklow Fire Service Attend To Fire On Coillte Lands Near Djouce Woodlands

Wicklow Fire Service Attend To Fire On Coillte Lands Near Djouce Woodlands

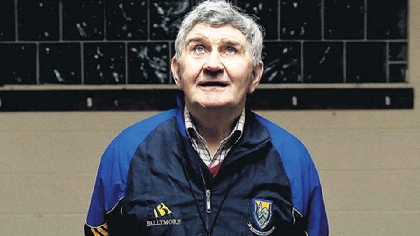

Tributes Paid To Former Wicklow GAA Manager Mick O' Dwyer Following His Death Aged 88

Tributes Paid To Former Wicklow GAA Manager Mick O' Dwyer Following His Death Aged 88

Planning Application Lodged To Turn Wicklow Pub Into IPAS Centre

Planning Application Lodged To Turn Wicklow Pub Into IPAS Centre

Inquest Hears 2 Year Old Girl Died Of Brain Damage Following Choking Incident At Greystones Creche

Inquest Hears 2 Year Old Girl Died Of Brain Damage Following Choking Incident At Greystones Creche